opening work in process inventory formula

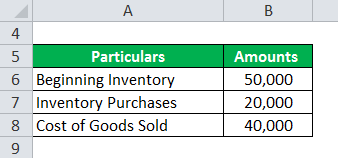

Do the same with the amount of new inventory. Beginning Inventory Formula COGS Ending Inventory Purchases.

Work In Process Inventory Formula Wip Inventory Definition

Work in process inventory examples.

. The conceptual explanation for this is that raw materials work-in-progress and finished goods current assets are turned into revenue. A work in process or WIP for short is the term that refers to any inventory thats been initiated into production but hasnt been completed by the end of a companys accounting cycle. Next multiply your ending inventory balance with how much it costs to produce each item and do that same with the.

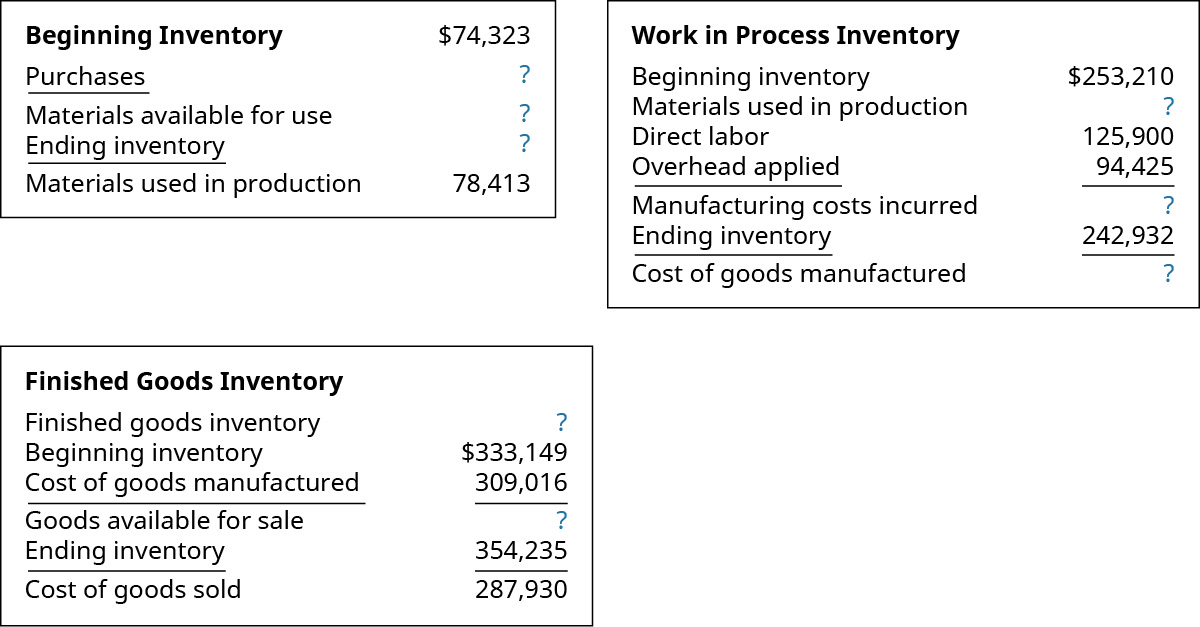

Determine the cost of goods sold COGS with the help of your previous accounting periods records. 44000 30000 14000. This figure is the ending work-in-process inventory for that quarter year or.

1500 x 20 30000. Its ending work in process is. This product value is important for financial reporting.

10000 300000 - 250000 60000. The formula for this is as follows. Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have.

Opening Inventory Cost of Goods Sold Ending Inventory - Purchases. For example you have run out of materials to create a certain amount of products. Multiply your ending inventory balance by the production cost of each inventory item.

Imagine BlueCart Coffee Co. It is part of a set of Process Efficiency measures that. Work in process inventory formula.

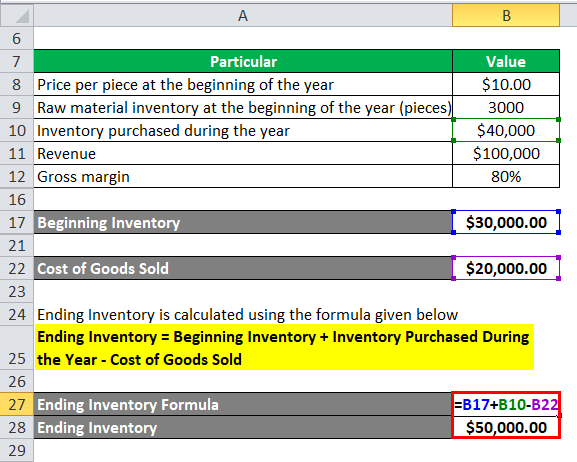

This beginning inventory equation or opening stock formula is. The value of all materials components and subassemblies representing partially completed production at plant cost for the most recently completed fiscal year. Ending Inventory Beginning Balance Purchases Cost of Goods Sold.

5000 Beginning WIP 29000 Manufacturing costs - 30000 cost of goods manufactured. Work-in-process WIP inventory turns This asset management measure is typically calculated as the cost of goods sold COGS for the year divided by the average on-hand work-in-process material value ie. That is how to find beginning inventory.

Production in terms of. How to Calculate Ending Work In Process Inventory. Another example would be one of your production equipment has broken down so your processes have come to a halt.

COGS Previous accounting period beginning inventory previous accounting period purchases previous accounting period ending inventory. The ending work in process inventory is then valued at. Formulas to Calculate Work in Process.

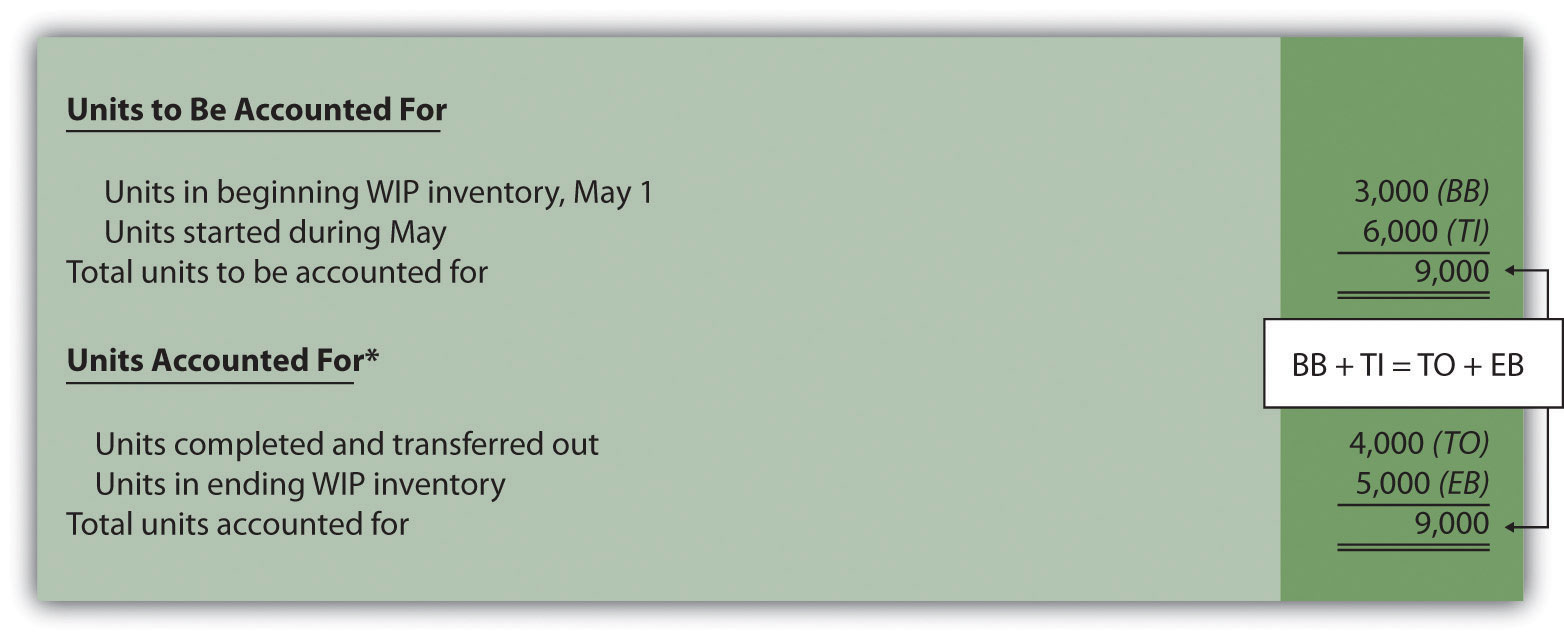

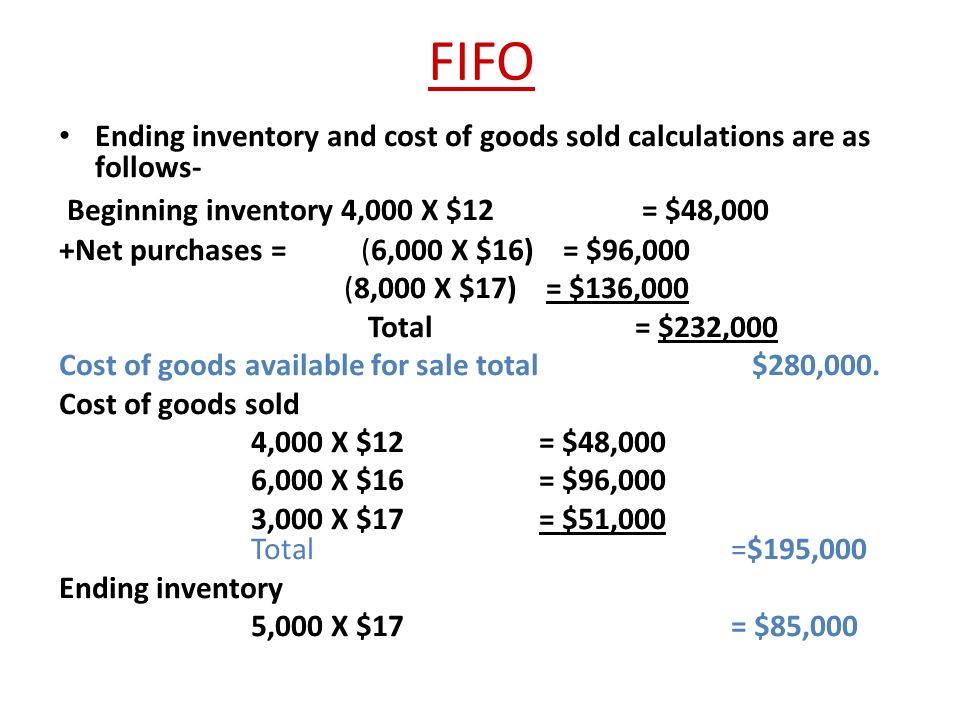

FIFO method assumes that those units which represent work-in-progress at the beginning are completed first and the units partly complete at the end of the period are units introduced or transferred from the preceding process during the current period. And the result for calculating beginning inventory cost will be as follows. During the month 287000 of costs were added to production and the cost of units t.

Higher sales and thus higher cost of goods sold leads to draining the inventory account. Calculating your beginning inventory can be done in four easy steps. Ending inventory Beginning inventory Inventory purchases Cost of goods sold or Ending Inventory Beginning Inventory Inventory Purchases.

Lets use a best coffee roaster as an example. As far as the calculations are concerned the formula for calculating work in process is. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods.

Work in process operating inventory goods in process raw material used during the period direct labor during the period factory overhead for period ending inventory. Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed. Over the year the company incurs 300000 in production costs and produces finished goods at a cost of 250000.

Accounting with Opening and Closing Work-in-Progress-FIFO Method. Work in process inventory 60000. The work in process formula is.

This formula can be used to calculate any of the four values given the other three are available. This results in a simple calculation to find opening inventory. Work in process operating inventory goods in process raw materials used during the period direct labor during the period factory overhead for a period ending inventory.

ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the month. In January one of the processing departments at Seidl Corporation had ending work in process inventory of 99000. As a result of this you would have to freeze the production process until you have bought the materials to use.

Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. Work-in-process inventory is calculated at the end of each accounting period. But if you already know the beginning inventory and ending inventory figures you can also use them to determine the cost of goods sold.

Has a beginning work in process inventory for the quarter of 10000. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. Work in Progress Inventory Formula Initial WIP Manufacturing Costs Cost of Goods Manufactured Costs - Cost Of Goods Manufactured Cost of Goods Manufactured Formula is value of the total inventory produced during a period and is ready for the purpose of sale.

Every dollar invested in unsold inventory represents risk. The work-in-process inventory that a company has started but not completed has specific value. The value of all materials components and subassemblies representing partially completed production divided by the value of WIP transfers per day assuming 365 days in a year.

4000 Ending WIP. Ending inventory Previous accounting period beginning inventory Net. Let us take a company ABC which manufactures widgets.

This measure determines work-in-process WIP inventory days of supply which is calculated as annual average WIP inventory value ie.

Work In Process Wip Inventory Youtube

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

How To Calculate Ending Inventory The Complete Guide Unleashed Software

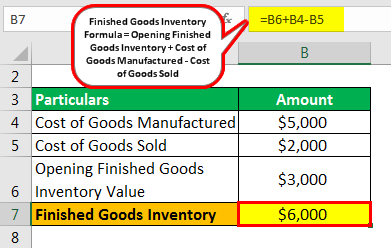

Finished Goods Inventory How To Calculate Finished Goods Inventory

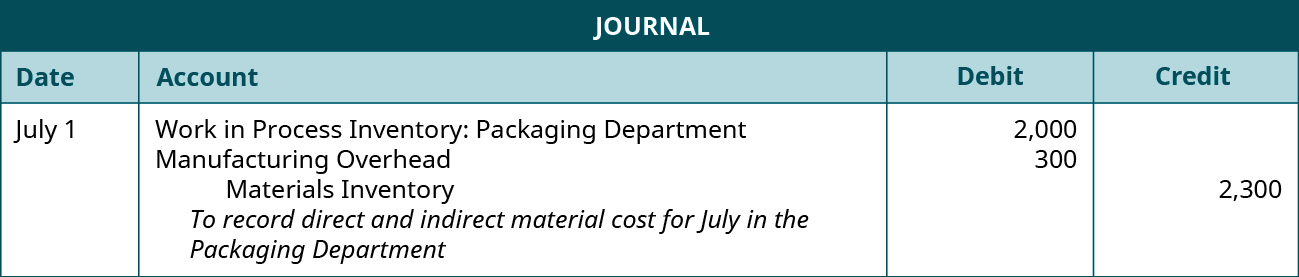

Prepare Journal Entries For A Process Costing System Principles Of Accounting Volume 2 Managerial Accounting

Cost Of Goods Manufactured Formula Examples With Excel Template

Inventory Formula Inventory Calculator Excel Template

Ending Work In Process Double Entry Bookkeeping

Average Inventory Formula How To Calculate With Examples

Wip Inventory Definition Examples Of Work In Progress Inventory

Manufacturing Account Format Double Entry Bookkeeping

Finished Goods Inventory How To Calculate Finished Goods Inventory

How To Calculate Ending Inventory Using Absorption Costing Online Accounting

How To Calculate Finished Goods Inventory

Ending Inventory Formula Calculator Excel Template

Inventory Formula Inventory Calculator Excel Template

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps